how much is inheritance tax in georgia

Inheritance tax usually applies when a deceased person lived or owned property in a state. 1 attorney answer.

State Estate And Inheritance Taxes Does Your State Have Them What Are They And How Should You Plan For Them Georgia Estate Plan Worrall Law Llc

If the total Estate asset property cash etc is over 5430000 it is subject to the.

. All inheritance are exempt in the State of Georgia. No estate tax or inheritance tax Alaska. After any available exemption you could owe 18 to 40 percent in taxes depending on the taxable amount.

All inheritance are exempt in the State of Georgia. Georgia does not have any inheritance tax or estate tax for 2012. The tax rate on.

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is. An inheritance tax is usually paid by a person inheriting an estate. No estate tax or inheritance tax Arizona.

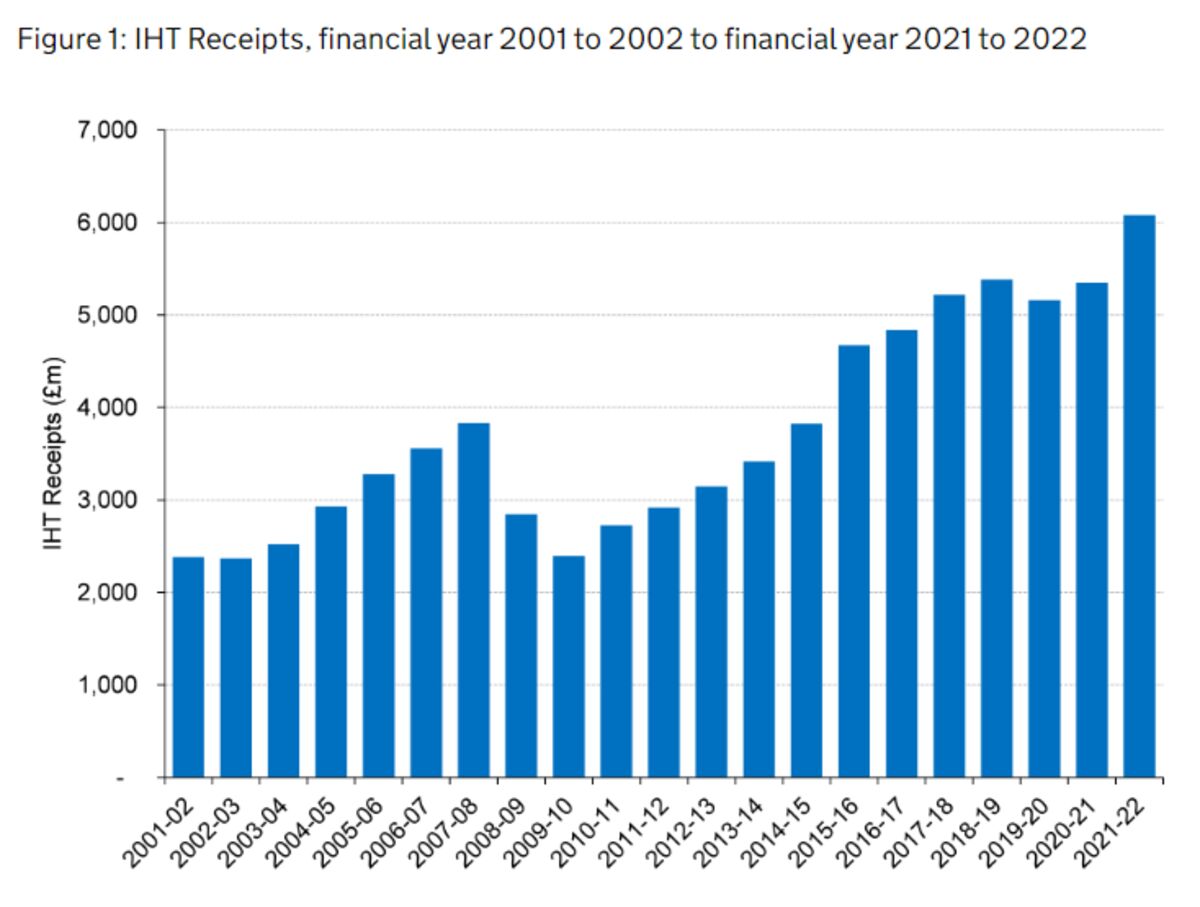

However it does not liberate Georgia residents from the Federal Estate Tax if the inheritance exceeds the exemption bar of 1206. State inheritance tax rates range from 1 up to 16. The Inheritance Tax charged will be 40 of 175000 500000 minus 325000.

Georgia inheritance law governs who is considered an heir or how assets are passed down when someone dies. There are NO Georgia Inheritance Tax. As of 2014 Georgia does not have an estate tax either.

The estate tax is paid based on the. How much can you inherit without paying taxes in 2020. Non-titled vehicles and trailers are exempt from TAVT but are subject to annual ad valorem tax.

Your estate is worth 500000 and your tax-free threshold is 325000. There are NO Georgia Inheritance Tax. No estate tax or inheritance tax Arkansas.

No estate tax or inheritance tax California. Learn everything you need to know here. Some states and a handful of federal governments around the world levy this tax.

Inheritance tax is imposed on the assets inherited from a deceased person. There is the federal estate tax to worry about potentially but the federal estate tax. If the total Estate asset property cash etc is over 5430000 it is subject to the.

New residents to Georgia pay TAVT at a rate of 3 New. The estate can pay Inheritance. For 2020 the estate tax exemption is set at 1158 million for.

The major difference between estate tax and inheritance tax is who pays the tax.

Estate Taxes After A Loved One S Death

Where Not To Die In 2022 The Greediest Death Tax States

Free Georgia Tax Power Of Attorney Form Rd 1061 Pdf Eforms

![]()

Title Ad Valorem Tax Tavt Georgia Consumer Protection Laws Consumer Complaints

What You Need To Know About Georgia Inheritance Tax

General Sales Taxes And Gross Receipts Taxes Urban Institute

Creating Racially And Economically Equitable Tax Policy In The South Itep

State By State Estate And Inheritance Tax Rates Everplans

What Is Inheritance Tax Probate Advance

5 Things To Know About Gift Tax Georgia Estate Planning Attorneys

Best Estate Tax Planning Lawyer Marietta Ga Faulkner Law

Atlanta Estate Tax Lawyer Ga Inheritance Litigation Lawyer

Instant Download Tax Planning Opportunities Following Georgia Senate Results By Jonathan G Blattmachr Robert S Keebler Martin M Shenkman Ultimate Estate Planner

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Here S Another Reason To Put Georgia On Your Retirement List

Does Georgia Have Inheritance Tax

Inheritance Tax Here S Who Pays And In Which States Bankrate

Dc Lowers Estate Tax Exemption To 4 Million Royal Law Firm Pllc